Global volatility is likely to continue.

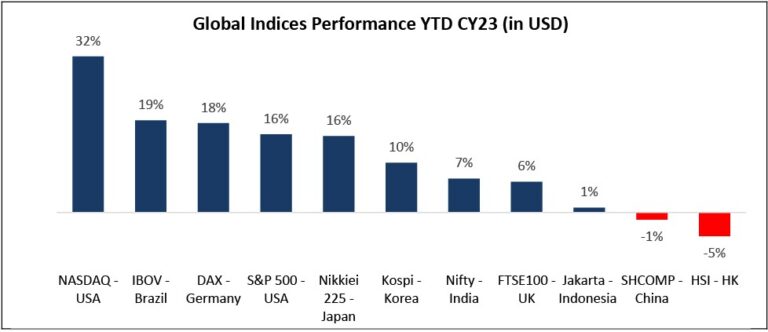

At the beginning of the year rising interest rates and the coming recession were the biggest worry weighing down the global markets. The markets have defied consensus and rallied sharply with Nasdaq being up 32% and S&P 500 rallying by 16% YTD. Inflation has not gone away; rates are still rising – can there be a soft landing as reflected in the market actions so far or will the initial fears come true though with a lag? This debate is likely to keep the global markets volatile.

Source: Bloomberg

Indian markets are up 7% YTD.

The Indian markets have been up 7% YTD in USD terms, with capex driven cyclical sectors outperforming.

Source: Bloomberg

Macro picture for India looks strong.

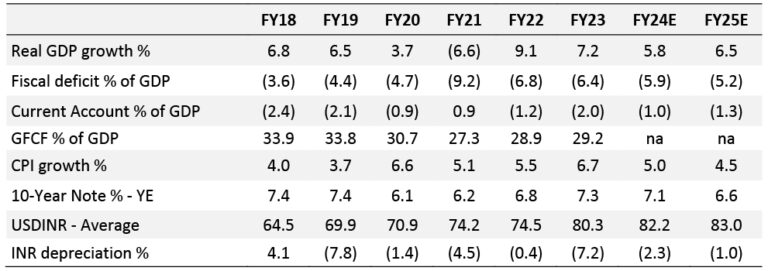

The macro picture for India continues to remain robust. Inflation seems to be coming in control, further increase in interest rates is likely to be driven by global factors. Capex cycle has picked up but mainly driven by government capex. Private corporate capex is yet to pick up steam. Corporate and banks’ balance sheets are strong. The current scenario is likely to sustain a 6-6.5% GDP growth. Having said that, long-term growth is never a straight line, greed or fear usually takes over to create the booms and busts.

There are three key risks to keep in mind:

Long-term India story looks very solid; however, every emerging market has a potential to surprise on the downside.

India Macro Indicators

Source: RBI, Kotak Securities

Foreign flows turn positive.

While the domestic flows have been steady, foreign flows turned positive. Strong flows were reflected in the broad rally in the market with the mid cap indices up 13.5% and small cap indices up 11.4%, both the indices have outperformed the Nifty YTD (up 6% YTD in Rs terms).

Source: MOSL, Bloomberg

Valuations not at peak but towards the higher end

Markets have recovered and are now trading towards the higher end of trading range but not the peak. Consensus earnings forecasts have been stable.

Source: Bloomberg, MOSL

Revisiting our thesis on Natco Pharma

Natco Pharma (Market Cap US$1.5bn) is one of the stocks in our portfolio which has underperformed so far. Let me take this opportunity to share with you the process that we follow if any of our stocks underperforms.

The company has a small branded generic oncology business and US business driven mainly by challenging patents in the US market. Company has been successful with few large drugs and few complex drugs which has given it burst of huge cashflows but volatility in earnings as seen in the chart below. In the recent past the company has been very successful with patent challenge on gRevlimid, a US$11bn drug where it was first to file and partnered the drug with Teva Pharma for front end marketing. The company gets to keep 30% of the economics. Our initial thesis was that the company will make cumulative cashflows of Rs40-45bn over the three years till the exclusivity is lost on gRevlimid and utilize the cashflow to strengthen the domestic business which will provide a base profit which will demonstrate steady growth and the patent challenge pipeline will continue to provide burst of cashflows going forward as well. However, the outcome of patent challenges is always hard to forecast.

The company has moved ahead with its strategy to get to more steady earnings. 1) It has diversified its market from US alone to Canada and Brazil, leveraging on its work already done for the US markets. 2) Based on its chemistry strength and understanding of patents, it launched the agrochemical business in the domestic market. This business was in an investment phase and will turn profitable from the current year. 3) With cashflows from gRevlimid, it continues to explore acquisition opportunities in domestic pharma market and 4) Increase investment in R&D for future US pipeline.

We believe the company can get to Rs4-5bn of annual steady profits and increase the optionality by R&D Investments for the US patent pipeline. Despite the market underperformance, we believe our thesis on Natco Pharma remains intact and hence we will continue to hold the stock.

Markets like steady and longevity in earnings much more than volatility, if Natco can get to a reasonable level of steady earnings with optionality of bursts of cashflow though patent challenges on top. The market will reward the management.

Source: Company, East Lane estimates

While we keep the macro backdrop in mind, our focus in East Lane remains on bottom-up stock ideas. We believe that a good management team, running a good business bought at a reasonable price will deliver the compounding in sync with the returns it generates over the long term.