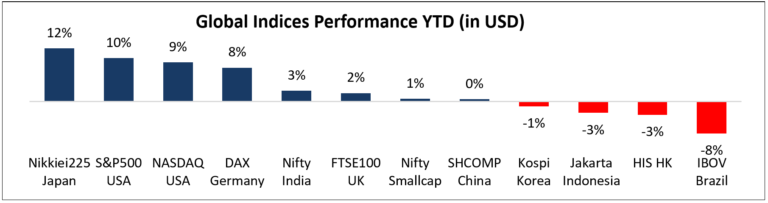

The Indian equity market has equities has done extremely well in the last 12 months. The Nifty 50 TRI index and the Nifty 500 TRI index delivered impressive gains of 30% and 40% impressively. Despite this strong performance for the year, there was some consolidation in the January-March 2024 quarter. The broader market was up 3% in USD terms and the small cap index, which had a very strong performance last year was flat for the quarter. Indian markets underperformed some of the key developed markets but continued to outperform emerging market peers. Despite recent correction in the market, cyclical stocks continue to outperform the defensive sectors. Both the FII and DII flows moderated but continued to remain positive. Valuations for the broader market are at the higher end of the trading band. Barring major surprises on the election front or sharp revision in global growth outlook, markets are likely to remain positive. Post-elections, the markets will look for strength of the capex cycle for continued performance of the cyclical sectors.

Developed markets and Indian small cap index reported strong performance YTD

Source: ELC, Bloomberg

Recovery phase => cyclical sectors outperforming in India

Source: ELC, Bloomberg

Recovery phase => cyclical sectors outperforming in India

Source: MOSL

Government continues to focus on fiscal consolidation

Despite an election year, the government has continued to remain fiscally prudent. The fiscal deficit will be reduced to 5.1%, inflation is trending down (unless monsoons are poor), interest rates are likely to remain a band in the foreseeable future. The current negative liquidity situation may ease and get to neutral territory. It seems the government is focused on a sustainable 6.5-7% growth for the economy.

Stable macro-outlook

Source: ELC, MOSPI, RBI, Kotak

Despite the broader markets doing so well, the Indian financial sector which is the largest part of the Indian stock market performed relatively poorly in FY24. The sectoral indices representing the financial sector viz. Nifty Bank and Nifty Financial Servies delivered a return of 17% each in the last 12 months. The key question really is whether it will make up for its relative under-performance going forward. Let me start with the big macro story on the financial sector.

Financialization of the Indian economy

With rising incomes, the financialization of the Indian economy is well in progress. Household savings moving away from physical assets to financial assets is a structural story for the long-term.

Financialization of savings

Source: RBI

While banks and NBFC’s will continue to play an important role, mutual funds, wealth management, insurance gain prominence in domestic savings. India is at an early stage of this shift when compared to other developed markets.

Nature of financial savings

Source: Crisil, AMFI, SEBI, IRDAI

Over the last decade, from being 17%, the financial sector is now 23% of the overall market capitalization. This increase in market capitalization has been largely driven by the emergence of new listings of asset managers, insurance, brokers, wealth managers etc.

Broadening of the listed financial sector

Source: ELC, ACE

The long-term story is structural but in the medium term the sector is cyclical

The last three years have seen the capital markets and public sector banks driving the performance, whereas private sector banks and insurance companies have underperformed. Public sector banks have seen a mean reversion in valuations coming out of a decade-long credit cycle. Buoyant markets and increased retail participation have driven the performance of the capital market players.

PSU banks and capital markets drive last three-year performance.

Source: ELC, ACE

Despite the emergence of new segments, banks will continue to remain over 50% of the financial sector. We deep dive into structural and cyclical drivers for the performance of the banking sector. Bank’s earnings are cyclical in nature driven by the credit or liquidity cycles. Longer-term performance is driven by superior returns they can generate through the cycle. If the return trajectory for a bank can sustainably improve, the markets will re-rate them and vice versa. However, the short-term performance is likely to be impacted by the near-term earning cycle.

Higher returns drive higher valuations

Valuations – a theoretical construct

Source: ELC

Liquidity is the key driver for the current cycle.

Liquidity is the key driver for the current cycle versus non-performing loans which drove the last cycle. The ability to garner deposits and hence loan growth is likely to be a key driver of the stock performance in this cycle.

Current cycle vs last decade

Source: ELC, RBI

State Bank is structural or cyclical story?

The last decade was the story of the credit cycle where the PSU banks suffered the most. As the balance sheet got repaired, the PSU mean reverted from extremely depressed value to fair value. While there is no structural change in the return profile expected, the key call is how long will the current cycle last. We believe the current liquidity cycle and the credit cycle is still in favor and continue to own State Bank of India in our portfolio.

Source: ELC, Company, Bloomberg

ICICI Bank on a structural re-rating path

ICICI Bank under the current management has structurally changed its return profile. From a cyclical corporate bank, the current management has been able to make a shift towards a more sustainable retail franchise. We believe the return trajectory has changed from 1.2% to 2% ROA going forward. The market has re-rated the bank, which in our view is sustainable. The bank will continue to perform in line with its earnings going forward.

Source: ELC, Company, Bloomberg

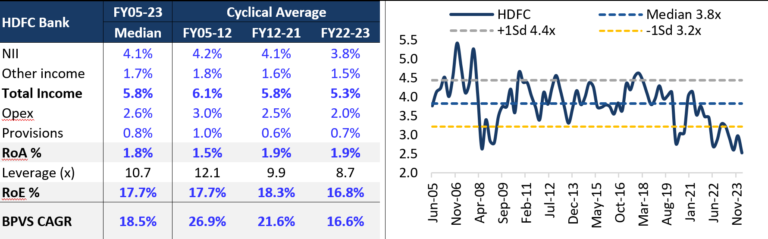

HDFC Bank market questions the recent merger?

HDFC bank has suffered a massive de-rating over the last three years. The bank’s business model has been built on low-cost deposits and strong underwriting skills. This resulted in a superior return profile and sustainable higher growth than the sector. The merger with HDFC Ltd has stretched the balance sheet and the change in the top management has further put a question mark on the ability to navigate the current cycle. The market is pricing the stock for a structural decline in return profile. The management needs to demonstrate that the superior deposit franchise is intact, and no undue risk will be taken on the balance sheet. Despite the underperformance we continue to hold the stock.

Source: ELC, Company, Bloomberg

We remain focused on bottom-up stock picking

At East Lane, we continue to look for stocks that can deliver sustainable long-term growth and are available at reasonable prices. As we head into the next fiscal year, we clearly see a lot of noise in the market due to elections not only in India but across many countries including USA. Further, there seems to be some unanimity in expectations that the interest rates will cool down a bit, but the quantum and timing remain unknown. At East Lane, our endeavor is to stay away from the noise as much as possible and focus on companies where we believe there is a long runway for growth, have profitable economics and the managements have the capability to deliver great results while maintaining the highest levels of integrity.