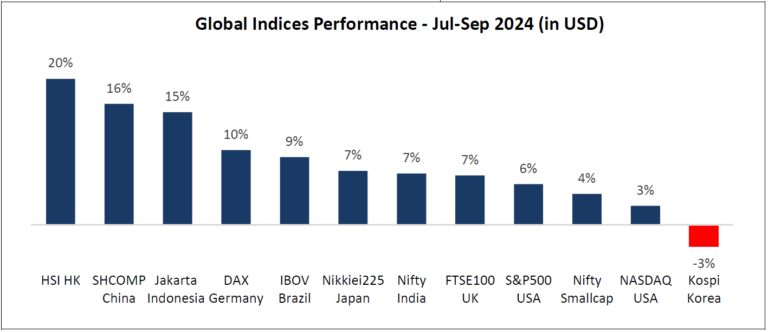

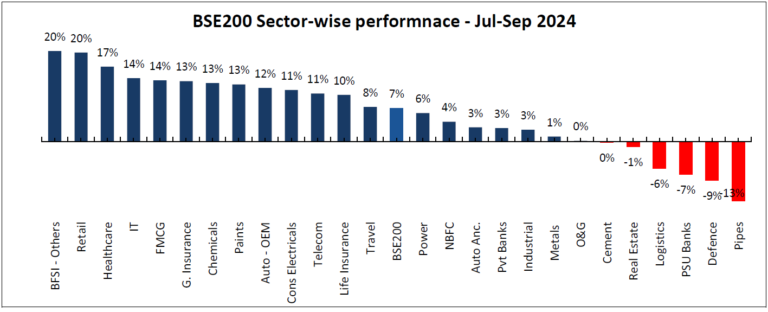

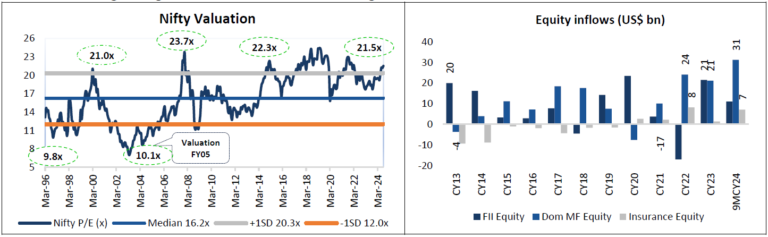

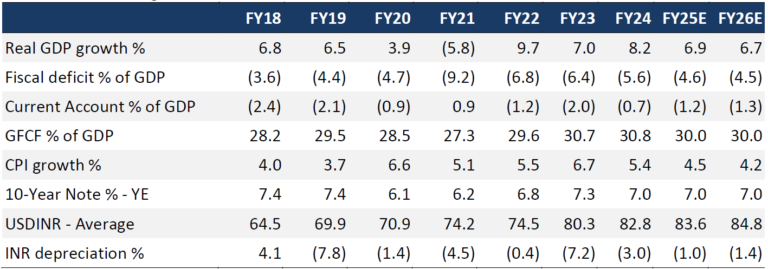

Indian markets are up 18% YTD but a more subdued 7% during the quarter gone by. After many quarters, defensive sectors outperformed cyclicals in this quarter. On the liquidity front, capital raises have increased significantly, however inflows into equities remain higher. The government remains focused on fiscal consolidation and the right capital expenditure; however, some state governments are turning more populist. Under the current macro environment 6.5-7% GDP growth looks sustainable. At 21.5x one year forward earnings, the market is trading at the higher end of the historic valuation range and there are many pockets of exuberance in the market. We don’t have a crystal ball to forecast the behavior of markets in the short to medium term but will like to discuss our framework to deal with volatility in this note.

Indian markets continue to report strong performance – 18% YTD

Source: ELC, Bloomberg

Defensive sectors outperform

Source: ELC, Bloomberg

Markets trading at higher end of the valuation range

Source: MOSL

Stable macro – GDP growth to sustain at 6.5-7%

Source: ELC, MOSPI, RBI, Kotak

Dealing with volatility – ‘Markets can remain irrational longer than you can remain solvent’

John Maynard Keynes

Source: MOSL

Markets will be volatile, to forecast short-term change in the mood of the market is difficult. However, as investors we must deal with volatility.

Let’s go back to the basics of what drives a stock. In very simplistic terms, performance of a stock price is an interplay of fundamentals i.e. earnings and a valuation multiple. Valuation multiple is nothing but a proxy to discounted future cashflows. Sometimes the market discounts far out in future and sometime the focus turns to near-term fundamentals leading to sharp corrections. Over the long-term earnings drive the stock performance, in the short-term sentiments can takeover fundamentals.

We can look at the same concept through a different lens. Let’s think about an individual stocks’ performance depending on three factors 1) opportunity to grow, 2) execution of the business model to generate returns and 3) capital allocation through organic or inorganic route to enhance opportunities for growth.

If there is a large runway for growth, the management is executing well and generating superior returns and allocating capital to sustain the growth at high returns you have a big winner on hand.

Sometimes the market is just focused on the opportunity and forgets about the execution and capital allocation.

Generally, in a bull market this happens with several stocks and whenever the markets focus changes back to fundamentals things end up in tears.

Keeping all the three factors in mind, helps us formulate our thesis on a stock. It helps us understand the fundamentals and what is being discounted in the price.

Let’s look at a few scenarios as to how this framework plays out in our portfolio. We would avoid situations where we are paying only for opportunity without any conviction on execution. There may be situations where the execution is strong, but the stock price is discounting far out opportunity. We may continue to hold the stock if we have not overpaid for the opportunity as our initial purchase price. We may buy stocks where there is a potential turnaround in execution or capital allocation and the opportunity remains reasonable. If the market turns, the biggest losers are likely to be stocks discounting opportunities far out with very little to show for execution.

We acknowledge that this is a simplistic framework and there are many more nuances to picking a stock but sometimes keeping things simple helps in dealing with more complex situations.

We take a closer look at the Auto Component sector and discuss Shriram Pistons a recent addition to our portfolio.

Auto component industry

Auto components is a B2B business, the auto OEM’s outsource parts to its vendor ecosystem. Overall, it is a large segment with US$ 74bn of domestic and export revenue.

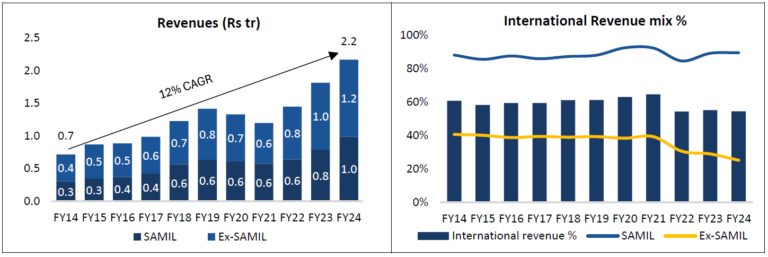

If we look at the key players listed in this segment the revenues have grown at a CAGR of 12% over the last decade, slightly ahead of the auto volume growth during this period. Domestic revenues have grown by 13% and international revenues by 10%. Due to its size and international acquisitions, Samvardhna Motherson (Market Cap US$ 17bn) skews the overall picture. If we exclude Samvardhan domestic revenues are up 14% and international revenues are up 6%. International business forms 55% (25% excluding Samvardhna) of the listed universe.

Source: ELC, ACE Equity

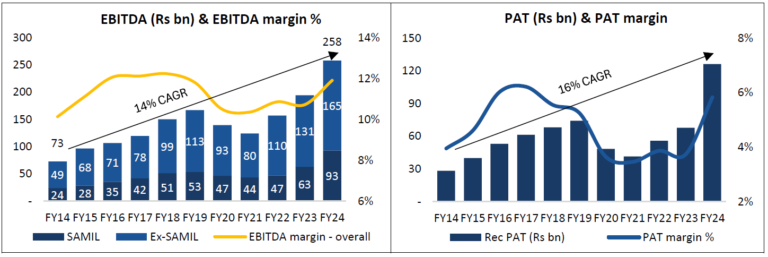

Like any manufacturing sector, on average EBITDA margins are 10-12% and have grown at 14% CAGR and PAT has grown at 16% CAGR over the last decade.

Source: ELC, ACE Equity

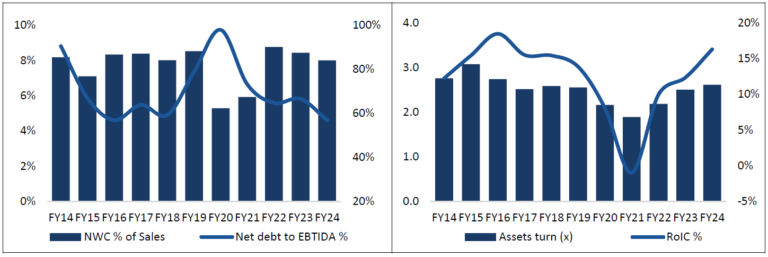

The listed universe balance sheets are clean with Net debt to EBITDA of 60-65%. Working capital turns are also healthy. The sector usually has an asset turn of 1.5-2x and makes a ROIC of 15%.

Source: ELC, ACE Equity

Since this is a B2B business the growth is also linked to the growth of the mother industry. How can a company outperform this growth? Increasing content per vehicle, moving up the value chain with more technology intensive products, premiumization of the product mix, increasing the contribution of international revenues or diversifying into non-auto segments. To drive these growth vector’s ability to get right technology partners and/or right acquisitions are critical.

Margins profile depends on the ability to execute well. High-capacity utilization, constant process innovation and moving to more technology intensive premium products are some of the key margin drivers.

Higher asset turns and margins will result in higher ROIC for an individual company. Investment in R&D is not very high and reliance on technology partnerships are critical for the companies.

Auto sector is undergoing a technology shift from Internal combustion engines to electric drive trains. This shift will cause a major disruption for the sector. Can the players adapt to the technology shift and how fast the change will occur will determine the sustainability of growth for the sector in the coming years.

The total market cap of the auto component sector is US$ 115bn which is 2% of the BSE500 market cap. Samvardhna Motherson and Bosch account for 30% of this market cap.

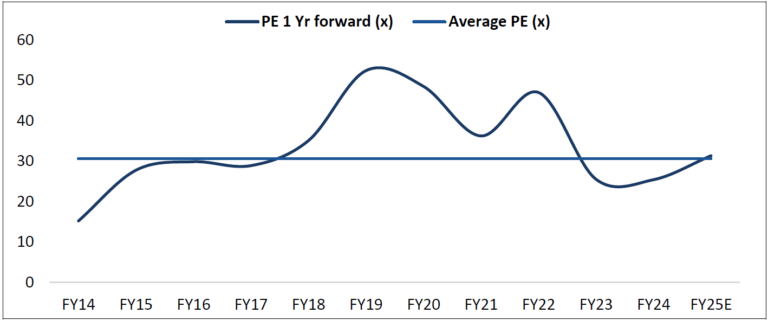

Auto Ancillary PE Band Chart

Source: ELC, ACE Equity, Bloomberg

Shriram Pistons (Market Cap Rs 90bn)

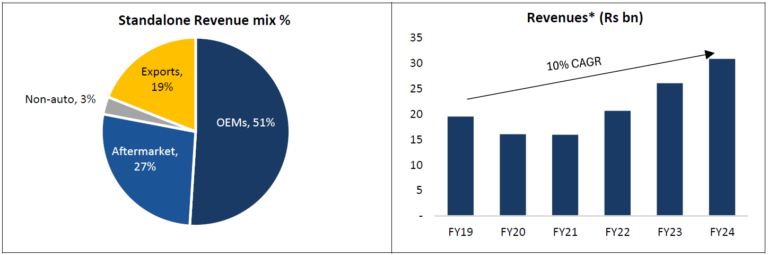

Shriram Pistons (SRP) manufactures pistons, piston rings and valves which are the heart of the ICE engine. The company reported revenues of Rs 31bn in FY24 and enjoys a dominant 45% market share in the domestic market. International revenues account for 19% and the company mainly services aftermarket in Europe and Latin America.

Source: ELC, Company, *Consolidated revenue

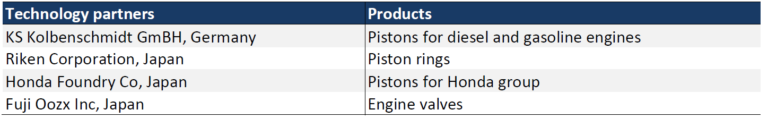

The company has technology tie-ups with the world leaders in pistons, pistons rings and engine valves technologies since inception.

Execution under the new management has significantly improved.

Post the management change in FY20, the company has seen a sharp turnaround in its execution which is reflected in improved margins. The new management has focused on process efficiencies, increasing capacity utilization and focusing on more profitable products. The EBITDA margins have improved to 20% which are sustainable going forward. The company reported net profits of Rs4.5bn in FY24.

Source: ELC, Company

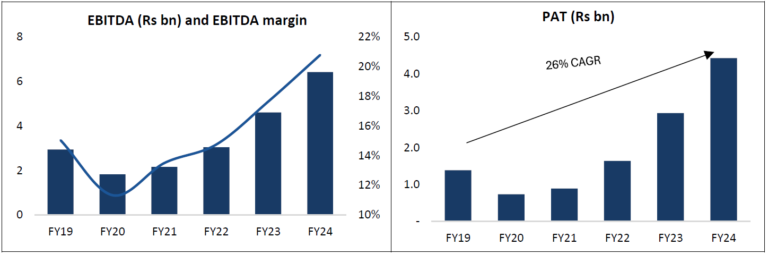

Healthy balance sheet and return ratios

The company has a net cash balance of Rs 6bn on its books and has improved its ROIC to 31% with improved margins.

Source: ELC, Company

How to protect from coming technology shift

The demise for ICE engines may take longer than expected and SPR will be the last man standing given the growth opportunity in Indian markets. SRP is increasing the contribution from alternate fuel pistons like CNG, hybrids etc. Opening new segments like snowmobiles, railways, marine, defense, tractors, harvesters etc. The company is using its cashflow to make acquisitions to diversify away from the ICE segment.

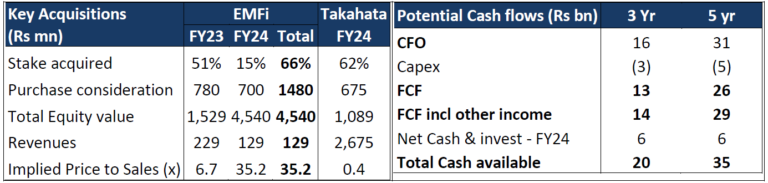

The company has recently made two acquisitions to diversify against dependence on ICE engines.

1) EMFi Innovations, Singapore a tech company in electric motors & controllers. For motors, the technology comes from Shenzhen Greatland Electric and for controllers it is from Wuxi Lingbo. 2) Takahata Precision – a high-precision plastic injection molded parts for automotive applications.

Going forward the company will continue to generate strong cash and will look for acquisitions in a very disciplined way. acquiring players with tech or high margins/ high ROE players. And the bench strength of the team is very strong to internalise these acquisitions.

Source: ELC, Company

Valuations are attractive

The company can grow profits at 16-18% compounded over the next three years, trading at 17X FY26 valuations look attractive.

Source: ELC, Bloomberg

In conclusion, the Indian markets continue to trade in the expensive range. Managing volatility is of paramount importance at this stage. At East Lane, we manage volatility by staying away from stocks that are discounting unrealistic growth projections and also the management ability to execute is suspect. We will stay invested and continue to look for opportunities where the growth potential is high, the managements have the capability to execute and the stock is reasonably priced.

I take this opportunity to wish you and your families a very Happy Diwali!