The beginning of a new year is a good time to look back as to what transpired during the year gone by and re-look at possible scenarios which could play out going forward. It always helps to analyse what worked and what did not to fine tune the longer-term thesis.

The year gone by has been a year of relative outperformance for India versus the developed world, while in absolute term the market did not do much. It has also been a year of mean reversion trade, driven by expectation of revival in capex cycle. Although FIIs sold US$17bn in equities, markets were supported by retail inflows and investment by EPFO. This was a significant departure from the past and remains to be seen if it holds true in future as well.

Looking Back – 2022 in retrospect

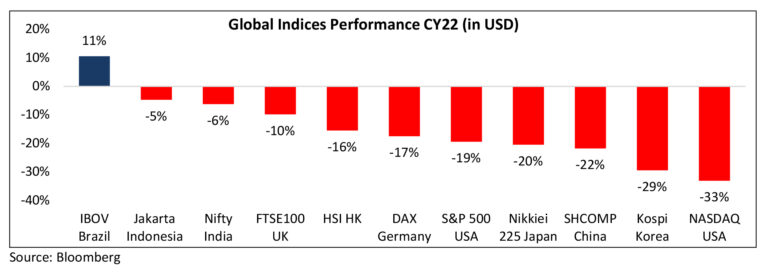

Inflation and monetary tightening were the two key driving themes for the markets in 2022. Loose monetary policy, supply chain disruptions during covid and high energy prices due to the Russia-Ukraine war triggered inflation. Central banks responded with monetary tightening. Consequently, long duration assets saw steep erosion in value. High PE – high growth companies suffered most. This is reflected in 33% decline in NASDAQ in 2022. Several emerging markets performed better, relative fiscal prudence during covid times compared to the developed world helped. Nifty 50 Index in India was up 4% in INR terms and -6% on US$. On its own the performance was nothing significant but compared to 15-20% decline in several developed markets the performance looked impressive.

Banking, defence related PSU’s, Auto’s outperformed Nifty whereas IT, Pharma, Consumer Durables underperformed the market. Within sectors also the mean reversion in valuations was noticed. For e.g. ITC was the key driver for performance of the FMCG sector.

There was a marginal downgrade to consensus earnings estimates to Nifty companies and valuations have held up for the market.

Looking ahead – Domestic factors are strong, vulnerability can emerge from external sector

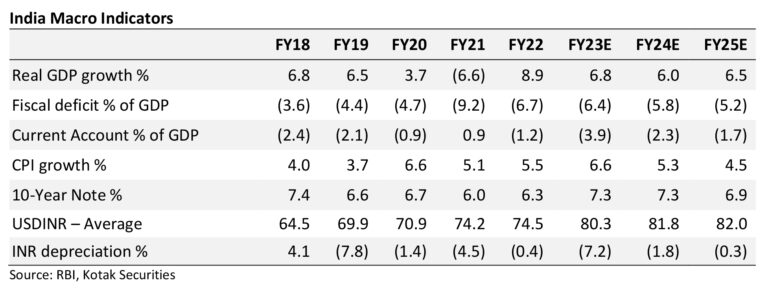

After a decade of deleverage the Indian corporates and banks have a clean balance sheet. Private sector capex has been missing and the capacity utilizations are picking up and real estate cycle is showing signs of revival. Government is likely to remain fiscally prudent and sustain a 6-6.5% GDP growth.

However, a slowing global growth can delay decisions by private sector to invest. The capex cycle is unlikely to be as strong as 2005-2008 cycle which was driven by domestic cycle and a synchronised global recovery. Current account at negative 3.9% is also a worry. The current account is expected to improve in FY24, but oil prices above US$100 can always play a spoil sport. High current account deficit drains out liquidity in the economy implying rising interest rates.

Longer-term structural story is attractive driven by micro

In our view, formalisation of the economy and entrepreneurs thinking scale is a structural theme which will continue to provide exciting opportunities.

If we look back at history of US economy,1955 onwards there was a boom in application of principles of management which allowed many businesses to scale. From roadside hamburger stands to evolution of McDonalds is one of the prime examples. McDonalds first designed end products, then it redesigned the entire process of making it, then it applied automation to many processes to gain efficiency and finally it studied what value meant to customers i.e., quality, predictability, speed of service at reasonable price.

The next logical step was to set standards and training processes and a business model to deliver their proposition at scale. There are many other examples of businesses like Walmart, General Motors, Dupont etc which scaled during that period.

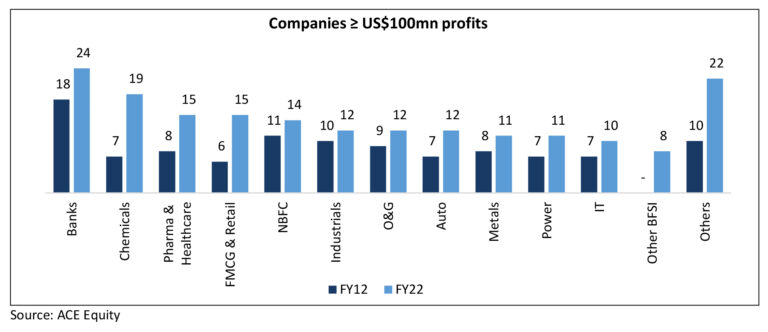

We analysed the BSE500 to see how many companies earn a profit of US$100m. In the initial stage, many small companies struggle to gain scale but if they reach a particular size their chances of success may improve. They are no guarantees, but the probability increases. In 2012 there were 78 companies out of the BSE500 who had a profit of US$100m which represented 21% of the index. In 2022 this number increased to 189 which represents 38%.

We strongly believe that India is at a stage where there are many businesses that can scale and our investment process is geared to look for companies that can scale and are available at fair value from an investment perspective.

Mean reversion in valuations can be very powerful in the short-term?

Mean reversion in valuations can be very powerful in the short term. As shown below, SBI and BOB over a period work identical with in the given valuation band. If BOB lags SBI by much there can be a catch-up trade. Last 12 months did see a catch-up trade in PSU banks from very cheap towards fair value. Fundamental trigger either for re-rating or de-rating will make a difference through the cycle.

There are structural and cyclical aspects to all businesses. Our focus is to understand the structural elements better. We look to understand the opportunity size, key drivers as to how the business makes money, management’s ability to execute and scale, the return profile of the business and a right valuation framework.

Changes made to the portfolio

During the quarter we exited our positions in Team Lease, Whirlpool and substantially reduced our holdings in Laurus Labs. We initiated a position in HDFC Bank.

We lost conviction in the scalability of staffing business for Team Lease in the medium term and the ability of Whirlpool to regain margins given the increasing competition. While we continue to believe in the longterm potential for the Laurus Lab’s CDMO business, near-term cyclical headwinds in its HIV portfolio and valuations prompted us to reduce position in the stock. HDFC Bank has a strong retail DNA, and we believe

will be able to grow ahead of the industry with recovering ROE post-merger with HDFC is consummated.

Valuations look reasonable.

As we look forward, the macro picture will remain uncertain. Will wage growth in the developed world and under investments in the commodity complex keep the inflation high? Will there be a soft landing or severe recession? How significantly India will get impacted by the global factors? Will government significantly change its fiscal policies, given the elections in 2024?

We do not have any edge on forecasting these events. While we keep the macro backdrop in mind, we remain focused on bottom-up stock selection – what is the long-term opportunity and how much of that is reflected in the price.

I take this opportunity to wish you and your loved ones a fabulous 2023.