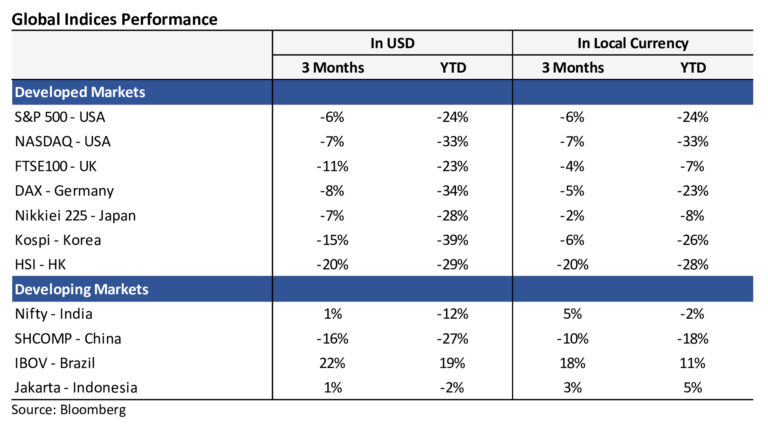

Global markets have turned volatile with a consensus emerging that we are at a structural change in the interest rate regime driven by loose monetary policy for decades resulting in high inflation. Geopolitics is further exacerbating the situation. Implications of high interest rates on global demand and potential for unanticipated accidents in the financial system will keep the markets volatile.

Some of the emerging markets like India have been resilient compared to the developed markets during the recent global turmoil. Recovering domestic growth and fiscally prudent government policies have been the reason for relative out performance. However, global markets are unlikely to decouple, at least in the short to medium term.

Keeping the base case assumption of increased volatility, how do we navigate the future. We will stick to our core process of focusing on micro i.e. how good is the business, how competent is the management, what is the fair price for such a business.

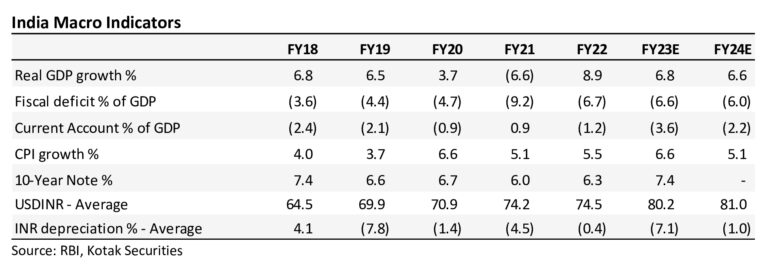

India Macro still reasonable

India is seeing a recovery in growth rates. The corporate and retail balance sheets are strong. Demand and capex recovery has just begun. Government has been fiscally prudent. If the fiscal deficit or current account continue to move up either due to government policy or global factors such as energy costs, we would turn more cautious.

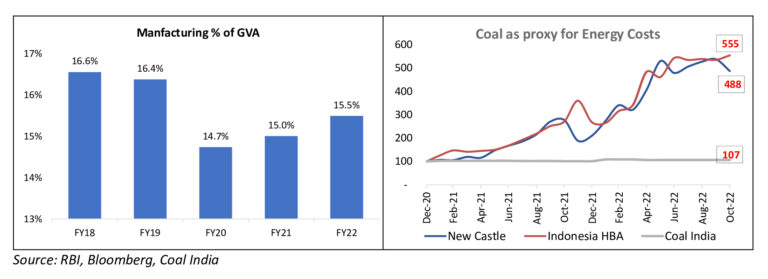

Is manufacturing becoming a large opportunity for India?

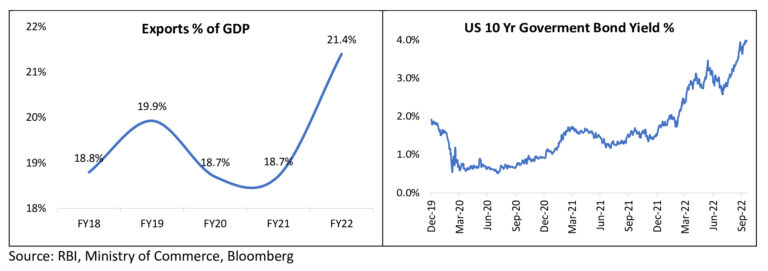

The current geopolitical offers an interesting opportunity for India both for import substitution and creating exports to increase its manufacturing to GDP ratio. Depending largely on domestic coal for electricity generation, power costs have become a big advantage for India in the current scenario. Government is encouraging set-up of manufacturing through offering incentives through Production Linked Incentive (PLI) schemes for various sectors. All of these are positive nudges and are getting reflected in the increase in exports in the recent past. How sustainable are these advantages? Geopolitics will continue to remain an advantage, but energy costs will normalise at some stage. India

has an opportunity, but the winners will be entrepreneurs who can think scale put the capex on ground and innovate to be globally competitive.

No decoupling from global factors

Global slowdown will be negative for nascent recovery in India. Exports though small as % of GDP can suffer if Europe and US were to go through a recession. Capital flows likely to become volatile in such a scenario. Rising interest rates globally can have unintended consequences as demonstrated in UK recently. India unlikely to remain immune to any major global events.

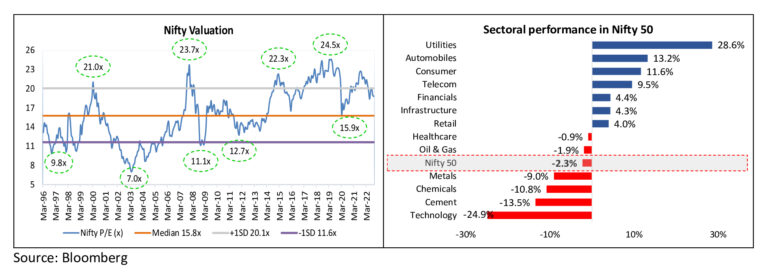

Market multiples still high

While the markets have corrected, they still trade towards the higher end of the valuation band. Over the last quarter domestic focused sectors like financials, utility, consumer, auto and telecom have outperformed. Export focused sectors like IT have underperformed the market.

We keep macro in mind, but focus remains on bottom-up stock picking

There are many factors which influence the markets. We are not experts on geopolitics or macro. We do keep a framework in mind but remain focused on the micro. We believe India will continue to provide attractive long-term opportunities. Changing attitude of entrepreneurs towards scale, capital allocation and innovation is what underpins our positive view. We will continue to focus on improving our understating businesses, managements to back and the fair value for such businesses. If we do our homework right and are patient, market volatility will provide opportunities.

Risk management in volatile times will become more critical. Management quality and balance sheet strength becomes even more important. Weaker business models suffer the most in such situations. Markets tend to get illiquid in downturns, continued conviction on our holdings is very important. We always look at our holdings with an open mind, if our thesis is not playing out, we would sell.

New addition during the quarter – Dreamfolks Services (Market Cap US$259m) We added Dreamfolks to the portfolio during the quarter. Dreamfolks is the largest airport service aggregator platform. The company aggregates the airport related services like lounges, other food &

beverages, spa, meet & assist, transit hotels, baggage transfers etc on one hand and card, networks (like Master & Visa), card issuing banks like HDFC, ICICI etc on the other hand. Dream Folks provides technology platforms between the two for a seamless customer experience.

In simple terms dream folks aggregates the lounge operators at various airports and helps the credit card customers to access the lounge service. The lounge charges the bank Rs 980 per customer and dream folks keeps 15% of the charge as its fee. Post opex the company can make about 8% net margins.

The domestic growth in travel is an opportunity, company can expand internationally starting from servicing the Indians traveling abroad. Company can also aggregate new services like discounts on duty free shops.

Unlike the key competitor Priority Pass where a different card is required to avail services, Dreamfolks technology platform enables it to be embedded within the card or the mobile app of the bank customer.

It is a capital light business model with 50% plus ROIC and almost 100% conversion pre-tax OCF (operating cashflow) to EBITDA. The business can grow at 30-40% over next 3-4 years and in our view current valuations do not discount the growth potential.